The GST Refund Exercise has ended on 31 Dec 2024. If you wish to submit or enquire about your GST refund claim , you can do so via our feedback form using the following classification.

Category Type: Enquiry

Category: Licensing and Salesperson Registration Matters

Sub-Category: GST Refunds |

Following the announcement by the Ministry of Finance (MOF) on 14 February 2024, government agencies which have wrongly charged GST on certain fees will be providing a refund for these previously charged GST amounts.

CEA will be taking steps to issue refunds for GST amounts previously charged on:

Application Fee for Estate Agent (EA) Licence

The Application Fee for EA Licence is payable to CEA for the purpose of processing the EA licence application or renewal. The application fee was increased from $100 to $120 with effect from 1 Jan 2024, and the wrongly charged GST on this fee

ranged from $7.00 to $10.80 per transaction, depending on the prevailing GST rate at the time.

Application Fee for Real Estate Salesperson (RES) Registration

The Application Fee for RES Registration of $50 is payable to CEA for the purpose of processing a RES’s registration (either new, renewal, or switching applications). The wrongly charged GST on this fee ranged from $3.50 to $4.50 per transaction,

depending on the prevailing GST rate at the time.

CEA has stopped charging GST for the above fees with effect from 14 February 2024. For GST that was wrongly charged before 14 February 2024, CEA will refund the GST, with interest, to eligible parties.

Refund Details and Frequently Asked Questions

Application Fee for Estate Agent (EA) Licence

For the periods for which your EA was GST-registered, your EA will not be eligible for a GST refund, as you would have claimed input tax from IRAS on this expense. No action is required from you.

If your EA has never been GST-registered or was only GST-registered for a partial period up to 13 February 2024, CEA will effect a GST refund to your EA for the relevant periods when your EA was not GST-registered. This will be done via

interbank transfer, starting from mid-March 2024. No action is required from you.

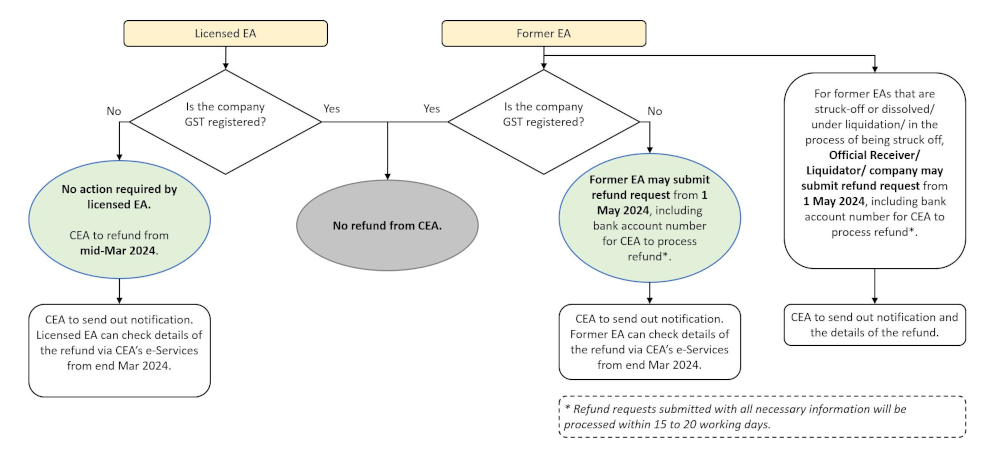

This flowchart summarises the refund process for the Application Fee for Estate Agent (EA) Licence.

Application Fee for Real Estate Salesperson (RES) Registration

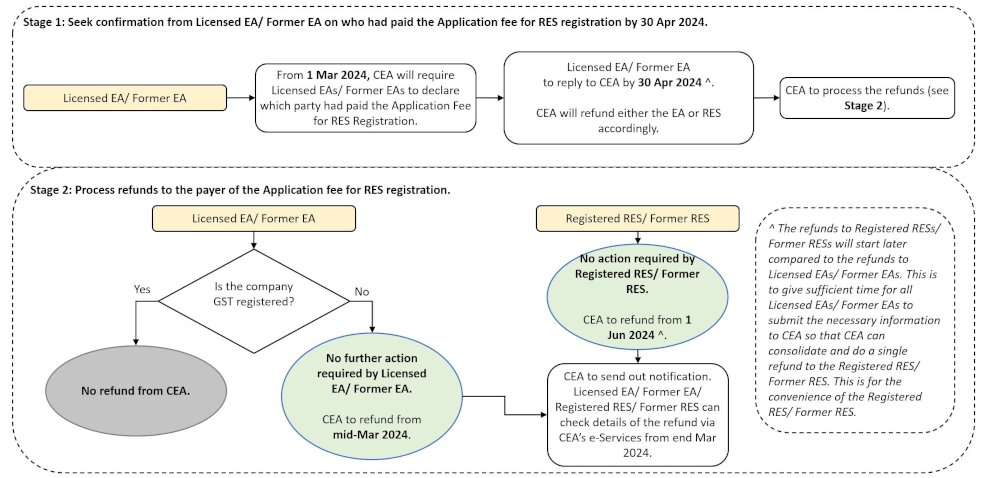

From 1 March 2024 - 30 April 2024, CEA will be requiring EAs and former EAs to submit declarations to CEA on whether they had borne the Application Fee for RES Registration on their RESs’ behalf.

- If the EA had borne the Application Fee (i.e., the RES did not pay for the Application Fee), then the EA may be eligible for a GST refund.

- If the RES had borne the Application Fee, then CEA will refund the wrongly charged GST directly to the RES.

From 1 March 2024, CEA will be contacting each EA and former EA individually with details of how to make this declaration. We seek your patience and understanding as CEA can only process refunds after the EAs have submitted their declarations. Eligible

RESs will receive their GST refunds from June 2024.

If you were an RES with an EA that no longer exists, please submit a refund request using the FormSG link that will be made available on CEA’s website for this purpose from 1 May 2024.

This flowchart summarises the refund process for the Application Fee for Real Estate Salesperson (RES) Registration.

For more details on the GST refunds, you can refer to the list of frequently asked questions and answers, or click

on the links which best fit your role:

Back to Top

GST Refund Forms

The GST Refund Forms are now closed. If you wish to submit or enquire about your GST refund claim , you can do so via our feedback form using the following classification.

Category Type: Enquiry

Category: Licensing and Salesperson Registration Matters

Sub-Category: GST Refunds

| Type of GST Refund form | Who should fill up the form | Reasons for filling up the form |

Declaration for Licensed/Former EAs on payment of Application Fee for RES Registration Note: Closed from 1 Jul 2024 | EAs who are currently or were previously licensed with CEA | For claims on Application Fee for RES Registration |

Declaration form for RESs on payment of Application Fee for RES Registration Note: Closed from 2 Jan 2025 | RESs who are currently or were previously registered with CEA | For dispute or claims on Application Fee for RES Registration |

Declaration for ACRA-live former EAs on payment of Application Fee for EA licence Note: Closed from 2 Jan 2025 | EAs who are no longer licensed with CEA, but remain live entities in ACRA | For claims on Application Fee for EA Licence |

Declaration for ACRA-non-live former EAs on payment of Application Fee for EA licence Note: Closed from 2 Jan 2025 | Judicial managers / Liquidators / Official Receivers of EAs who are no longer licensed with CEA and no longer live entities in ACRA | For claims on Application Fee for EA Licence |

Declaration form for RESs to provide bank account details for GST refunds Note: Closed from 2 Jan 2025 | RESs who do not have NRIC-linked PayNow and wish to provide bank account details for GST refunds | For claims on Application Fee for RES Registration |

Back to Top

Useful Links

Back to Top

Further Enquiries

For further enquiries, you may reach out to us in any of the following ways:

- Submit an enquiry via CEA’s website

- Use our Ask CEA virtual assistant on the CEA website

- Call us at 1800-643-2555

Kindly note that airtime charges apply for mobile calls to 1800 service lines and calls are free of charge only if made from regular land lines. Please check with your telecommunications provider for more details.

Back to Top