If you are a current or former Real Estate Salesperson (RES), you can find out more about:

Refund of Application Fee for RES Registration

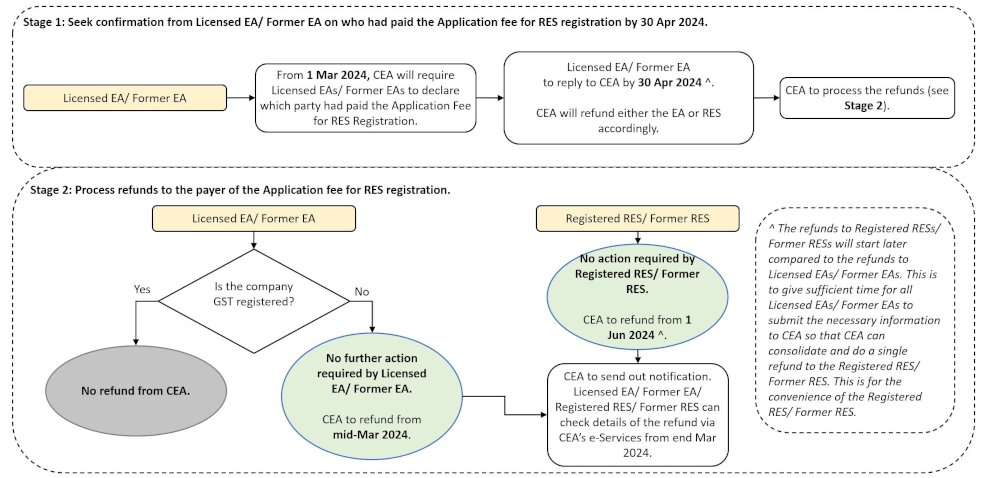

CEA is aware that the Application Fee for RES Registration may be borne by you or your EA, depending on the contractual agreement between you and your EA.

From 1 March 2024 to 30 April 2024, CEA will be requiring your EAs (current and former, if any) to submit declarations to CEA on whether they had borne the Application Fee for RES Registrationon your behalf.

- If your EA(s) had borne the Application Fee (i.e., you did not pay for the Application Fee), then you are not eligible for a GST refund.

- If you had borne the Application Fee, CEA will refund the wrongly charged GST directly to your bank account via PayNow linked to your NRIC. If you do not have a NRIC-linked PayNow bank account, please contact your bank to link your NRIC to PayNow

before 1 June 2024.

As your EAs (current and former, if any) will require time to complete the declarations to CEA, we seek your understanding that if you are eligible for a GST refund, we will only be able to effect this from June 2024. CEA seeks your patience

and understanding as we will also need time to process and pay the refunds.

Some of your former EA(s) may no longer exist. In this situation, please submit a claim to CEA.

For your convenience, we will set up a 'GST Refund' module in CEA’s e-Services, available from end March 2024. Through this module, you will be able to check the details and status of your GST refund, including whether your EAs have submitted the

details to CEA.

This flowchart summarises the refund process for the Application Fee for RES Registration.

For more information on the GST refunds, you can refer to Notice 04-24 (For Current RESs) (PDF, 1.02MB),

Notice 04-24-FORMER RES (For Former RESs) (PDF, 1.1MB),

and the list of frequently asked questions and answers below.

Back to Top

Frequently Asked Questions

Am I eligible for a refund of the GST amounts for the Application Fee for RES Registration?

CEA is aware that the Application Fee for RES Registration may have been borne by you or your EA (current and former, if any), depending on the contractual agreement between you and your EA (current and former, if any).

From 1 March 2024 to 30 April 2024, CEA will be requiring your EAs (current and former, if any) to submit declarations to CEA on whether they had borne the RES Registration Application Fee for on your behalf.

If your EA had borne the Application Fee, then you are not eligible for a GST refund. If you had borne the Application Fee, then CEA will refund the wrongly charged GST directly to you. No action is required from you.

Do I need to submit any supporting documents to CEA?

No, there is no action required on your part.

When can I expect the refund to be made, if I am eligible?

CEA seeks your patience and understanding as we will need time to process and pay the refunds. Your EAs (current and former, if any) will also require time to complete the declarations to CEA.

If you are eligible for a GST refund, we seek your understanding that we will only be able to effect this from June 2024. Please contact CEA from 1 July 2024 if you believe you are eligible for a refund, but have not received it by then.

My former EA no longer exists. How do I claim my refund?

In this situation, please submit a claim to CEA using the FormSG link that will be made available on CEA’s website for this purpose from 1 May 2024.

How will the refunds be made?

If you had borne the Application Fee, CEA will refund the wrongly charged GST directly to your bank account via PayNow linked to your NRIC. If you do not have a NRIC-linked PayNow bank account, please contact your bank to link your NRIC to PayNow

before 1 June 2024.

My next-of-kin was a former RES affected by the collection but has passed away. Can I collect the refund on his/her behalf?

From 1 May 2024, please visit the GST Refund webpage on CEA’s website to submit a refund request form to CEA.

For more FAQs on the GST refunds, you can refer to the list of general frequently asked questions and answers.

Back to Top