If you are a former licenced estate agent (EA), you can find out more about:

Refund of Application Fee for Estate Agent (EA) Licence

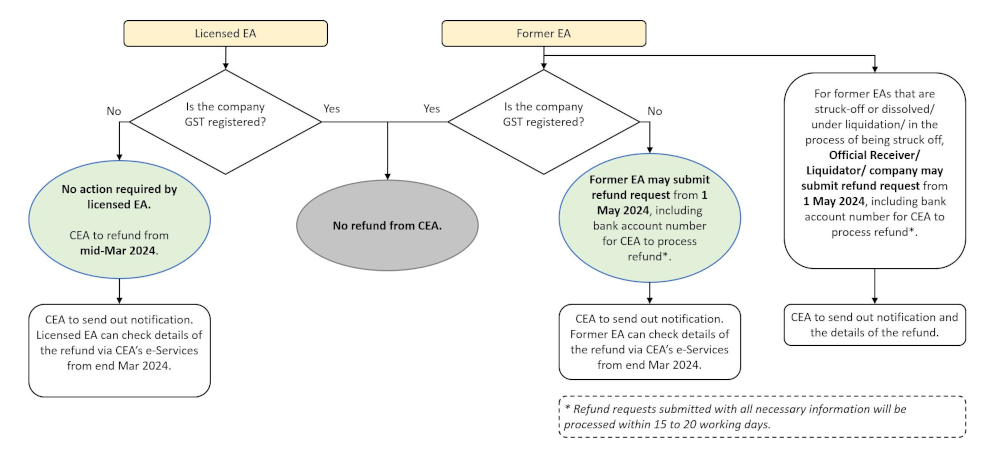

If your former EA was GST-registered for the entire period from your inception till the expiry of your licence, you are not eligible for a refund, as you would have claimed input tax from IRAS on this expense.

No action is required from

you.

If your former EA was never GST-registered or was only GST-registered for a partial period from your inception till the expiry of your licence, you may be eligible for a GST refund for the relevant periods when you were not GST-registered.

If you

wish to request for this GST refund, please submit a refund request using the FormSG link that will be made available on CEA's website for this purpose from 1 May 2024.

This flowchart summarises the refund process for the Application Fee for Estate Agent (EA) Licence.

Back to Top

Refund of Application Fee for Real Estate Salesperson (RES) Registration

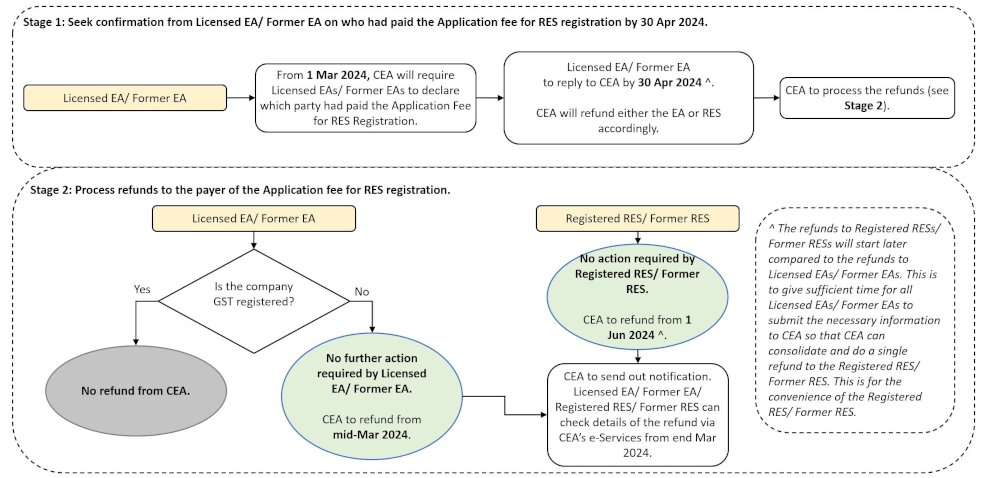

CEA understands that some former EAs may have borne the Application Fee for RES Registration on behalf of your former RESs, depending on the contractual relationship with your RESs at the time.

- If the former EA had borne the Application Fee (i.e., the RES did not pay for the Application Fee), then the former EA may be eligible for the GST refund.

- If the former RES had borne the Application Fee, then CEA will refund the wrongly charged GST directly to the former RES.

We will require former EAs to declare this information to CEA in order to process the refunds. From 1 March 2024, CEA will be contacting each former EA individually with details of how to make this declaration. Former EAs will be required to complete

the declaration and respond to CEA by 30 April 2024. No action is required from you until you hear from CEA in March 2024.

For your convenience, CEA will set up a 'GST Refund' module in CEA’s e-Services, which will be available from end March 2024. Through the module, you can check the details and status of your GST refund.

This flowchart summarises the refund process for the Application Fee for Real Estate Salesperson (RES) Registration.

For more information on the GST refunds, former KEOs can refer to Notice 03-24-FORMER KEO (PDF, 130KB) the list of frequently asked questions below.

Back to Top

Frequently Asked Questions

Application Fee for EA Licence

Will my former EA receive the refund of the GST amount for the Application Fee for EA Licence?

As your former EA was GST-registered, your former EA would have claimed input tax from IRAS. Hence, your former EA will not be eligible

for a refund.

If your former EA was not GST-registered, your former EA may be eligible for the refund of the GST amount for the Application Fee for EA Licence. If you wish to request for this GST refund, please submit a GST refund request

to CEA using the FormSG link that will be made available on CEA’s website for this purpose from 1 May 2024.

My former EA was only GST-registered for a partial period till the licence expired. Will my former EA still be eligible for a refund for the period when it was not GST registered?

If your former EA was only GST-registered for a partial period from 1 May 2012 to 13 February 2024, you may be eligible for a GST refund for the relevant periods when you were not GST-registered. If you wish to request for this GST refund, please submit a GST refund request to CEA using the FormSG link that will be made available on CEA’s website for this purpose from 1 May 2024.

Does CEA need any documents from my former EA to process the refund?

CEA would need your company’s bank account details to effect the GST refund. CEA will process and refund the GST amount for the Application Fee for EA Licence to you thereafter.

If eligible, how will the refunds be made?

If eligible, the GST refund will be made to your company via interbank transfer.

Application Fee for RES Registration

My former EA sponsored and paid for the Application Fee for RES Registration for our former RESs. Will we get a refund of the GST amounts for this fee?

CEA understands that some former EAs may have borne the Application Fee for RES Registration on behalf of their former RESs, depending on the contractual relationship with their former RESs. In this case, your former EA may be eligible

for the GST refund. CEA will be reaching out to former EAs on the next steps, from 1 March 2024.

How will I know if my former EA is eligible for the GST refund for the Application Fee for RES Registration?

CEA will require you to declare if you or your former RESs had borne the Application Fee for RES Registration. From 1 March 2024, CEA will be contacting each EA (current and former) individually with details of how to make this declaration.

EAs (current and former) will be required to complete the declaration and respond to CEA by 30 April 2024. No action is required from you until you hear from CEA in March 2024.

If eligible, how will the refunds be made?

If eligible, the refund will be made to your company via interbank transfer.

For more FAQs on the GST refunds, you can refer to the list of general frequently asked questions and answers.

Back to Top