Dec 2021 - 7 min read

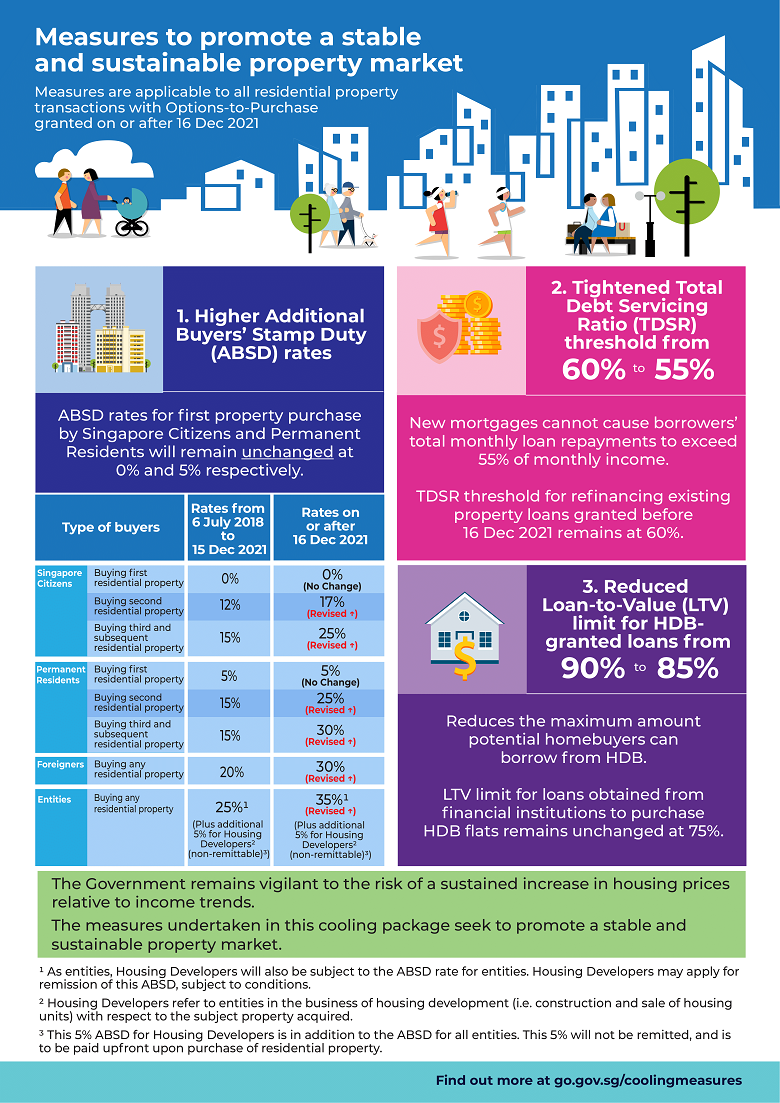

The Government has implemented a set of measures to cool the private and public housing markets, and promote continued affordability. The private residential measures are calibrated to dampen broad-based demand, especially from those purchasing property for investment rather than owner-occupation. Measures to tighten financing conditions will encourage greater financial prudence.

#1 Why are cooling measures needed?

Both the private residential and HDB resale markets have been buoyant, despite the economic impact of COVID-19. If left unchecked, we run the risk of an unsustainable housing price increase and a destabilising price correction in the future. Borrowers may also be left vulnerable to likely interest rate hikes in the future.

The government has thus introduced these measures to promote a sustainable property market, and prioritise housing purchases for genuine owner-occupation.

Image: Ministry of National Development (MND)

#2 Will these tightening measures hinder first-time homebuyers looking to purchase a house?

a) The latest cooling measures do not affect housing purchases for genuine owner-occupation.

- The changes to the Additional Buyer’s Stamp Duty (ABSD) rates aim to moderate demand for those who are purchasing residential property for investment.

- The ABSD rates for Singapore Citizens and PRs purchasing their first residential property will remain unchanged.

b) At the same time, the tightening of financial conditions encourage prudent borrowing among homebuyers.

- The tighter Total Debt Servicing Ratio (TDSR) threshold will prompt some prospective borrowers to consider more affordable housing options, and provide an additional buffer against potential income reductions or interest rate increases.

- The reduction in Loan-to-Value (LTV) limit for HDB loans is not expected to affect first-timers significantly as they can enjoy generous housing grants of up to $80,000 for new flat buyers and up to $160,000 when buying resale flats.

c) We are committed to ensuring that housing remains affordable and accessible to first-time homebuyers.

#3 Doesn’t the Government’s move to tighten the TDSR and LTV limit for HDB loans run contrary to Governments’ efforts to keep housing affordable?

a) Most HDB buyers have TDSRs of less than 55%, thus they are not expected to be affected by the tightening of the TDSR threshold from 60% to 55%.

- Those who buy an HDB flat are also subjected to a maximum Mortgage Servicing Ratio (MSR) of 30% and would generally not be affected by the reduction in the TDSR limit.

b) The reduction in LTV limit for HDB housing loan is not expected to affect first-timer buyers significantly as they can enjoy generous grants.

- When taking a HDB housing loan, buyers also must use their CPF savings to pay for the flat. They can only retain up to $20,000 in their CPF OA accounts per buyer, thereby reducing the loan amount they need to take.

- Based on all buyers who took up an HDB housing loan in 2020, only a small proportion of households (1%) with an income of less than $7,000 have an LTV above 85%, and will be affected.

| Average household income | Proportion of HDB Buyers (BTO and Resale) in each income group with LTV >85% |

| ≤ $7,000 | 1% |

| $7,001 - $12,000 | 7% |

| > $12,000 | 13% |

Note: Based on all buyers who took an HDB housing loan in 2020

c) In the long run, these measures will help to moderate property price increases and keep public housing affordable.

For more information on the cooling measures, please refer to: https://www.mnd.gov.sg/newsroom/press-releases/view/measures-to-cool-the-property-market

Information accurate as at 22 December 2021