Five Common Public Housing Myths

Image: Ministry of National Development

Image: Ministry of National Development

Feb 2023 - 3 min read

Amidst ongoing discussions on the rising prices of HDB flats and the increasing demands for housing needs, let’s bust five commonly heard myths about public housing affordability and accessibility.

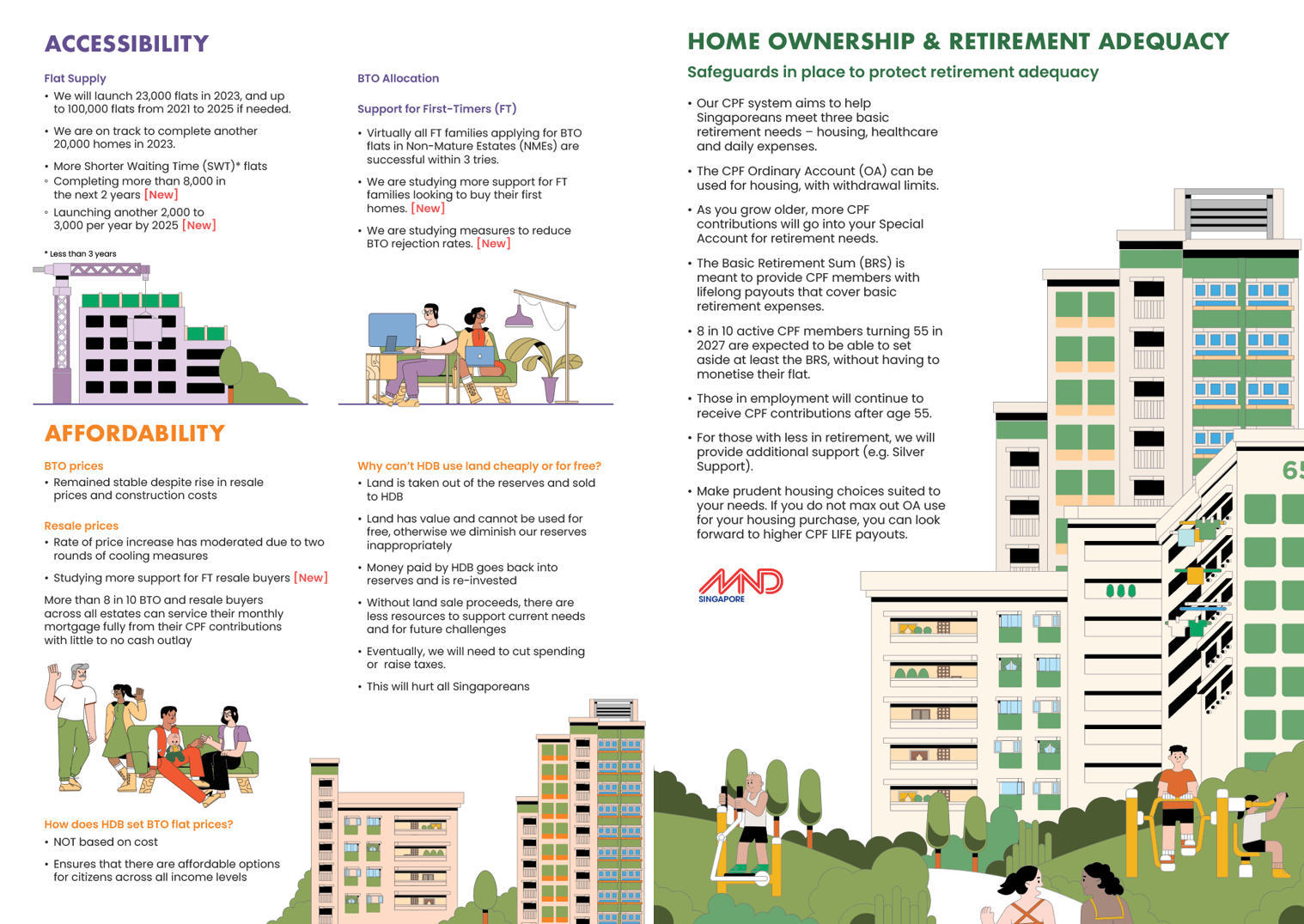

Myth 1: BTO prices have been increasing steeply.

Fact: BTO prices have been kept almost flat in the last 2 years despite strong demand and rising construction costs. HDB varies the market subsidies to ensure BTO prices remain affordable and stable.

In 2019, the average price of 4-room BTO flat in a non-mature estate (NME) was priced at $341,000 (before grants). In 2022, the average price was $342,000, and the price has barely changed.

Myth 2: Public housing is unaffordable.

Fact: More than 80% of buyers who collected their keys to BTO flats or bought resale flats in 2022 can service their monthly mortgage fully from their CPF contributions with little to no cash outlay. At the median household income of $8,400, about 70% of the BTO flats launched in 2022 can be affordably purchased at a Mortgage Servicing Ratio of 25% or less.

Generally, our home-price to income (HPI) ratios are four to five times. This means that it takes around four to five years of total household income to buy a home. This is considerably lower compared to HPIs in many other major cities (e.g. London, LA, Hong Kong) which range from eight to 20 years, or even more.

Myth 3: BTO prices will be lower if HDB does not pay for land costs.

Fact: HDB does not price flats based on costs. HDB prices flats based on affordability for buyers, rather than passing on costs for buyers or making a profit.

HDB looks at household incomes across different levels and establishes what the prices of flats should be to keep them affordable for buyers.

Myth 4: Our flat supply has not kept up with demand.

Fact: We have grown HDB supply in step with demand. From 2001 to 2021, HDB increased flat supply by 29%, while the number of residents living in HDB flats only increased by 10%.

We are catching up on COVID-19 delays and have made good progress. HDB has completed more than 20,000 homes across 22 projects in 2022, and is on track to complete another 20,000 flats across 22 housing projects in 2023. This is HDB’s highest number of flats completed annually in the past five years.

We will also launch up to 23,000 new flats in 2023, and up to 100,000 new flats in total from 2021 to 2025, if needed.

Myth 5: It is difficult for first-timers to secure a BTO flat.

Fact: 90% of first-timers are invited to book their flats within two tries when they apply for a BTO in non-mature estates, and virtually all succeed within tries.

Many young couples have not been successful in securing a BTO flat because they are trying hard to secure one in a mature estate. However, mature estates are already built up and available new land is limited. We encourage first-timer couples not to put family plans on hold, and consider a BTO flat in a non-mature estate first.

We will continue to review how we can better allocate flat supply to meet the most urgent housing needs. For example, we are studying how more support can be provided for first-timer families looking to buy their first BTO flat and looking at measures to reduce the high rejection rate for BTO applications. We will also consider if more housing support can be given to first-timers buying a resale flat. These will be announced when ready.

Image: Ministry of National Development

Image: Ministry of National Development

Information accurate as at 10 February 2023