Aug 2023 - 3 min read

On 15 August 2023, the police announced its largest anti-money-laundering operation which involved 105 real estate properties and the arrest of 10 foreigners. The properties included residences such as good class bungalows, condominiums, and commercial & industrial spaces. This matter also raised public interest on how the real estate agency industry works with the authorities to prevent money laundering through property transactions. This article reminds estate agents (EAs) and real estate salespersons (RESs) of your responsibilities towards Singapore’s fight against money laundering.

Duties that EAs and RESs have to fulfil

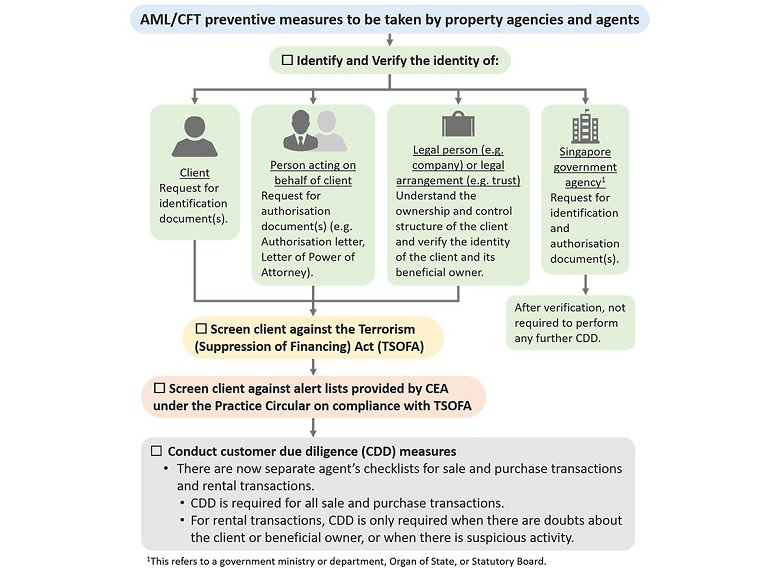

The Council for Estate Agencies (CEA) requires EAs and RESs to fulfil several duties under the Estate Agents Act 2010 (EAA) and the Estate Agents (Prevention of Money Laundering and Financing of Terrorism) Regulations 2021 (PMLFT Regulations) to prevent money laundering. These duties include:

- Conducting customer due diligence (CDD) on your clients before entering into any business relationship or transaction with them. RESs are required to identify and verify the identity of your clients, as well as assess the risk of your clients being involved in money laundering activities.The following flowchart illustrates how to conduct CDD for different types of entities.

- Reporting any suspicious transactions or activities to the Suspicious Transaction Reporting Office (STRO) of the Commercial Affairs Department (CAD), Singapore Police Force.

- Keeping records of your CDD measures, including any documents or information obtained during the process. These records must be kept for a minimum of five years.

- EAs must implement internal policies, procedures and controls to prevent money laundering or financing of terrorism activities.

Penalties for non-compliance

As part of our regular compliance work, CEA inspects EAs to check if they and their RESs have complied with the PMLFT Regulations. Those who fail to comply with the EAA and its subsidiary legislation could be subjected to disciplinary action by CEA’s Disciplinary Committee, such as the imposition of financial penalties (up to $200,000 per case for EAs, and up to $100,000 per case for RESs) and/or revocation or suspension of the EA’s licence and RES’ registration. CEA may also censure and/or impose financial penalties of up to $5,000 on the errant EA or RES under the EAA.

The requirement for filing a Suspicious Transaction Report (STR) is under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992.

CEA had developed a list of suspicious indicators aimed at assisting EAs and RESs on such matters. This had been circulated to the real estate agency industry in 2022 as part of CEA’s Guide on PMLFT Regulations (version as at March 2022) which is published on CEA’s website, and remains a relevant guide for EAs and RESs on your duties to prevent money laundering.

For more information, please refer to CEA’s PMLPFTF Guide.

Information accurate as at 3 July 2025