New rules on CPF usage and HDB loans to give buyers more flexibility, ensure homes for life

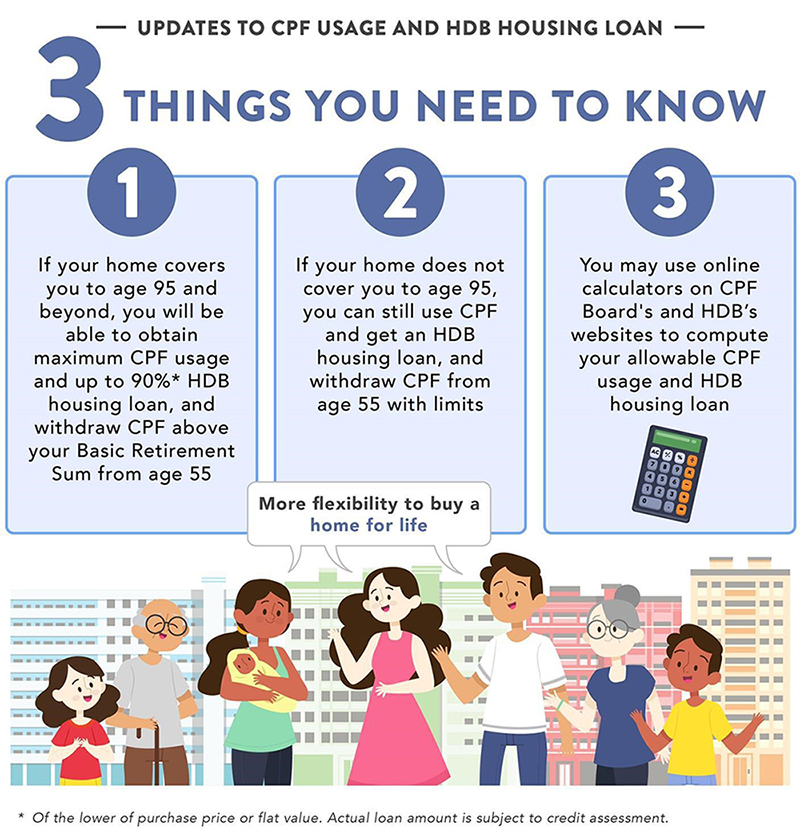

The Ministries of Manpower and National Development have announced updated rules on Central Provident Fund (CPF) usage and Housing and Development Board (HDB) housing loans.

The changes, which took effect from 10 May 2019, apply to the purchase of HDB flats, Executive Condominiums, and private residential properties.

The ministries said that the rules were updated to take into account the changing needs and higher life expectancy of Singaporeans. Collectively, the changes will provide more flexibility for Singaporeans to buy a home for life, while safeguarding their retirement adequacy.

What are the new CPF rules and how have they changed?

Under the new rules, the total amount of CPF that can be used for property purchase will depend on the extent the remaining lease of the property can cover the youngest buyer to the age of 95:

| Remaining lease of property at the point of purchase* is at least 20 years and can cover youngest buyer until at least the age of 95 | New rules on total use of CPF (with effect from 10 May 2019) |

| Yes |

|

| No |

|

*For HDB flats, the point of purchase refers to the flat application date. For Executive Condominiums and private properties, the point of purchase refers to the Option to Purchase or the Sale & Purchase Agreement exercised date.

In addition, under the new rules, no CPF can be used if the remaining lease of a property is less than 20 years. This has been lowered from 30 years previously, to be aligned with the existing criteria for HDB loans. The change was made to ensure continued prudent use of CPF monies.

CPF withdrawal rules for individuals above 55 years old have also been updated. With effect from 10 May 2019, CPF members above the age of 55 will need to have a property with sufficient remaining lease to cover them until at least the age of 95, before they can withdraw their CPF savings above the Basic Retirement Sum. This is to encourage CPF members to have a home for life and to secure at least a basic level of retirement income.

This change is not expected to affect most CPF members, as all HDB flats and the vast majority of private properties have leases that can last a 55-year old member until the age of 95.

What are the new HDB housing loan rules for flat buyers?

Buyers are now able to take an HDB housing loan of up to the full 90 per cent Loan-to-Value (LTV) limit if the remaining lease of the flat can cover the youngest buyer to the age of 95. This is even if the flat has less than 60 years left on its lease.

If the remaining lease of the flat cannot cover the youngest buyer to the age of 95, buyers can still take an HDB loan but the LTV limit will be pro-rated from 90 per cent, based on the extent that the remaining lease can cover the youngest buyer to the age of 95.

The LTV limit refers to the maximum amount of loan a flat buyer can take up, expressed as a percentage of the lower of the purchase price or flat value. The actual loan amount is subject to credit assessment, which takes into account, among others, buyers’ income and age.

When did the new rules take effect and who’s affected?

The updated rules took effect from 10 May 2019. The updated rules apply to:

- HDB flats: Flat application received on or after 10 May 2019

- Executive Condominium units and private properties: Option to Purchase or Sales & Purchase Agreement signed on or after 10 May 2019

- CPF withdrawals: Application received on or after 10 May 2019

The Ministry of National Development has said that most buyers will not be affected by the changes. About 98 per cent of HDB households and 99 per cent of private property families have a home that lasts them to 95 years and older.

Buyers who bought properties before 10 May 2019 and are still servicing their housing loans will not be affected by these changes.

Members who bought their property and turned 55 years old before 10 May 2019 can continue to apply to CPF Board to withdraw their CPF savings above their Basic Retirement Sum under the previous rules.

Those who are mid-way through a property purchase can approach CPF Board or HDB for clarifications and assistance.

Where can buyers find out about their allowable CPF use for property and HDB housing loan?

Buyers can use the following online calculators made available by CPF Board and HDB:

- CPF usage (for public and private housing)

- HDB housing loan

- - New flat

- - Resale flat