Apply for an estate agent licence

Apply for a new estate agent licence. Take note of the key points, such as licensing criteria and fees.

On this page

For new estate agents

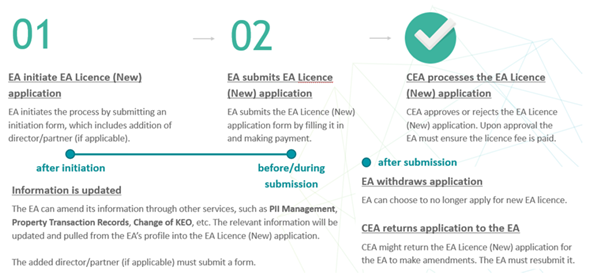

Any entity that conducts estate agency work, whether through a real estate salesperson (RES) or digital platform, is required to apply for an estate agent (EA) licence. The application must be submitted by the Key Executive Officer (KEO) of the EA through Council for Estate Agencies’ (CEA) Advanced CEA Estate Agencies System (ACEAS) . Please see FAQ 2 on how to submit an EA licence application (ACEAS).

Note:

If you are an existing EA who is changing your mode of business (e.g., from sole-proprietorship to company or general partnership to sole-proprietorship), you are required to submit an application for a new EA licence.

Licensing criteria for new estate agents

New EAs must meet the following licensing criteria:

Must be a registered entity with ACRA

Must have a KEO who satisfies the requirements of the Estate Agents Act and Regulations. (see section on KEO-eligibility criteria)

Must not hold a moneylender's licence

None of the EA's directors or partners or sole-proprietor or KEO hold a moneylender's licence, or are an employee, director, or partner of a licensed moneylender

Must be fit and proper, e.g., not in liquidation or wound-up or in receivership, has not entered into a composition or scheme of arrangement with its creditors, does not have any convictions, does not have any judgment that involved a finding of fraud, dishonesty, or breach of fiduciary duties entered against it in civil proceedings (see next section on 'Being fit and proper')

The EA's KEO and all directors or partners or persons responsible for the management must fulfil the fit and proper criteria under the Estate Agents Act.

The EA must have a valid Professional Indemnity Insurance (PII) policy that covers the EA and all its RESs for the validity period of its estate agent licence. All the partners, where applicable, must also be covered by the Professional Indemnity Insurance. (see section on PII)

The EA must have Standard Operating Procedures and guidelines such as for training & supervision of RESs, complaints-handling & dispute resolution, advertising & printing of publicity materials, protection of confidentiality of clients' information and service standards for its operations. Please refer to the Practice Circular for Estate Agents on Guidelines for Developing Standard Operating Procedures for more information.

Being fit and proper

CEA will determine if the person is fit and proper for registration after considering all relevant facts and matters. Registrants are required to declare all prior convictions in a court of law (including a military court), in Singapore or in any other country regardless of when the convictions occurred. In the circumstances listed below, a person shall not be fit and proper for registration, unless CEA determines otherwise:

Where the person has been convicted of an offence involving dishonesty or fraud, or any offence under the Estate Agents Act

Where the person has had a judgment entered against him/ her in civil proceedings that involve a finding of fraud, dishonesty, or breach of fiduciary duties on his/ her part

Where the person is an undischarged bankrupt or has made a composition or arrangement with his/ her creditors

Where CEA takes the view that a person is not fit and proper after considering any other relevant facts or matters

Example

A person who was previously detained under the Misuse of Drugs Act or served with a detention/ police supervision order under the Criminal Law (Temporary Provisions) Act would generally be deemed to be not fit and proper for registration, unless CEA determines otherwise after considering all facts and matters (including circumstances of the prior detention/ supervision).

Professional Indemnity Insurance

EAs and RESs are required to be covered by Professional Indemnity Insurance (PII). PII protects EAs and RESs, who can be held legally liable for claims arising from wrongful acts committed during the performance of professional services, including negligent acts, errors, and omissions or breaches of professional duty.

EAs are required to purchase a PII policy which sufficiently covers both the EA and all its RESs.

While CEA has established minimum requirements, EAs and RESs can choose to purchase policies with higher coverage. EAs and RESs can refer to the following for more information.

CEA's PII requirements:

Category | Minimum Indemnity Limit* | Minimum Sub-limit for each salesperson | Maximum Deductible (in respect of each claim against entity) | Maximum Deductible (in respect of each claim against salesperson) |

Sole-Proprietorship with only 1 salesperson | $100,000 | $100,000 | $5,000 | $5,000 |

Non-sole-proprietorships with 1-10 salespersons or Sole-proprietorship with 2-10 salespersons | $200,000 | $100,000 | $5,000 | $5,000 |

Estate agent with 11-30 salespersons | $300,000 | $100,000 | $5,000 | $5,000 |

Estate agent with 31-50 salespersons | $400,000 | $100,000 | $5,000 | $5,000 |

Estate agent with 51-500 salespersons | $600,000 | $100,000 | $10,000 | $5,000 |

Estate agent with >500 salespersons | $1 million | $100,000 | $20,000 | $5,000 |

* The minimum indemnity limit can cover both the entity and its salespersons.

KEO eligibility criteria

The appointed KEO of the EA must:

Have a minimum of 4 GCE O-Levels passes or equivalent

Possess a pass in the real estate agency (REA) examination in the 2 years immediately before the application for a licence, or equivalent.

Be a sole-proprietor, director, or partner of the EA

Have at least 3 years’ experience in estate agency work (e.g., applicant has held a RES registration for at least 3 years, or has been a KEO, practising director, or practising partner for at least 3 years)

Have:

Concluded at least 30 transactions in the last 3 years as or on behalf of a licensed EA; or

At least 3 years of experience in managing the business of a licensed EA as an executive director, a chief executive, key executive officer, partner, or sole proprietor

Not currently be a sole-proprietor, practising director or partner, KEO, or RES of another licensed EA

Not been previously a sole-proprietor, KEO, director, or partner of an EA whose licence was revoked

Not hold a moneylender's licence and is not an employee, director, or partner of a licensed moneylender

Must be up-to-date with your MediSave contributions under the Central Provident Fund Board (CPFB)’s Self-Employed Scheme – either paid in full or have an active GIRO plan with CPF Board. This also applies to directors and partners of the EA.

To check your MediSave payment status or make payment arrangements for any outstanding MediSave payable, please visit the Self-employment dashboard via your Singpass login.

Important Note

The information above, except for having an REA examination pass, also applies to the practising partners in General and Limited Partnerships, Limited Liability Partnerships, and practicing directors in Companies.

For applications involving foreigners, EAs should first check with CEA on the type of employment pass they should possess.

Licence & registration fees

For estate agents (EAs)

The Application fee for a new licence or renewal of licence is $120 (GST exempt).

For Annual licence fees, please refer to the two tables below for (i) All Businesses and Companies (ii) General Partnerships and Limited Partnerships.

Annual licence fee for all businesses and companies (except General Partnerships and Limited Partnerships)

Size of EA | Annual Licence Fee# (GST exempt) |

1 to 10 | $330 |

11 to 30 | $660 |

31 to 50 | $1,100 |

51 to 500 | $2,200 |

501 to 1000 | $5,000 |

1,001 to 2,000 | $10,000 |

2,001 to 3,000 | $15,000 |

3,001 to 4,000 | $20,000 |

4,001 to 5,000 | $25,000 |

5,001 to 6,000 | $30,000 |

6,001 to 7,000 | $35,000 |

7,001 to 8,000 | $40,000 |

Every additional 1,000 RESs | Increase of $5,000 |

# Half rates apply for the prescribed licence fees, for EA licence granted after 30 June and ending on 31 December of each calendar year.

Annual licence fee for General Partnership and Limited Partnerships

Size of EA | Annual Licence Fee# (GST exempt) |

1 to 10 | $330 + ($280 for each practising partner) |

11 to 30 | $660 + ($280 for each practising partner) |

31 to 50 | $1,100 + ($280 for each practising partner) |

51 to 500 | $2,200 + ($280 for each practising partner) |

501 to 1000 | $5,000 + ($280 for each practising partner) |

1,001 to 2,000 | $10,000 + ($280 for each practising partner) |

2,001 to 3,000 | $15,000 + ($280 for each practising partner) |

3,001 to 4,000 | $20,000 + ($280 for each practising partner) |

4,001 to 5,000 | $25,000 + ($280 for each practising partner) |

5,001 to 6,000 | $30,000 + ($280 for each practising partner) |

6,001 to 7,000 | $35,000 + ($280 for each practising partner) |

7,001 to 8,000 | $40,000 + ($280 for each practising partner) |

Every additional 1,000 RESs | Increase of $5,000 + ($280 for each practising partner) |

#: Half rates apply for the prescribed licence and registration fees, for EA licence and RES registration granted after 30 June and ending on 31 December of each calendar year.

For real estate salespersons (RESs)

Fee Type | Amount (GST exempt) |

Application fee for RES registration | $60 |

RES registration fee granted for a. A full calendar year, or part of a calendar year starting on or before 30 June and ending on 31 December | $280 |

b. Part of a calendar year starting after 30 June and ending on 31 December | $140 |

Notes:

Upon approval of the EA licence, the EA shall establish a GIRO account with CEA for payment purposes.

EAs shall be responsible for the payment of all fees, i.e., the application fee for EA licence, the annual licence fee, as well as the application fee for RES registration and the RES registration fee for its RESs.

The application fee for RES registration is also payable when an EA submits an application for a RES to switch EAs (leaving/ intending to leave one EA to join another).

Invoices will be generated every Monday, Wednesday, and Friday (excluding Public Holidays or on days where there are ad-hoc system maintenance) for applications at “Pending fee payment”. GIRO deduction by the bank will take place and complete in the next two to three working days.

Please note that fees paid are not refundable.

Processing your application

We will take approximately two to three weeks to process an application, upon receiving all the required supporting documents and payment of the applicable fees. Once approved, we will inform you of your application status through your email address provided in the application form.

Duty to notify CEA of changes to information submitted in any application or form

EAs or KEOs shall notify CEA of any change to the information contained in any application or form submitted to CEA within 7 working days after the date of the change, once an EA is licensed.

This can be done through ACEAS and includes changes such as:

Changes in the EA Information (e.g., change of business address or email address)

Changes in the KEO Information. If a vacancy occurs in the post of KEO by reason of the death, resignation or revocation of appointment of the KEO, the EA shall appoint another KEO within one month of the KEO ceasing to carry out his duties

Changes in existing practising Directors/ Partners Information. If you are appointing a new practising director/ partner, you can find out more about the registration criteria

Cessation of RES’s authority to act for the EA, i.e., cancellation of a RES registration