Buying an HDB flat (Buyer)

Here is what you need to know when buying an HDB resale flat on your own.

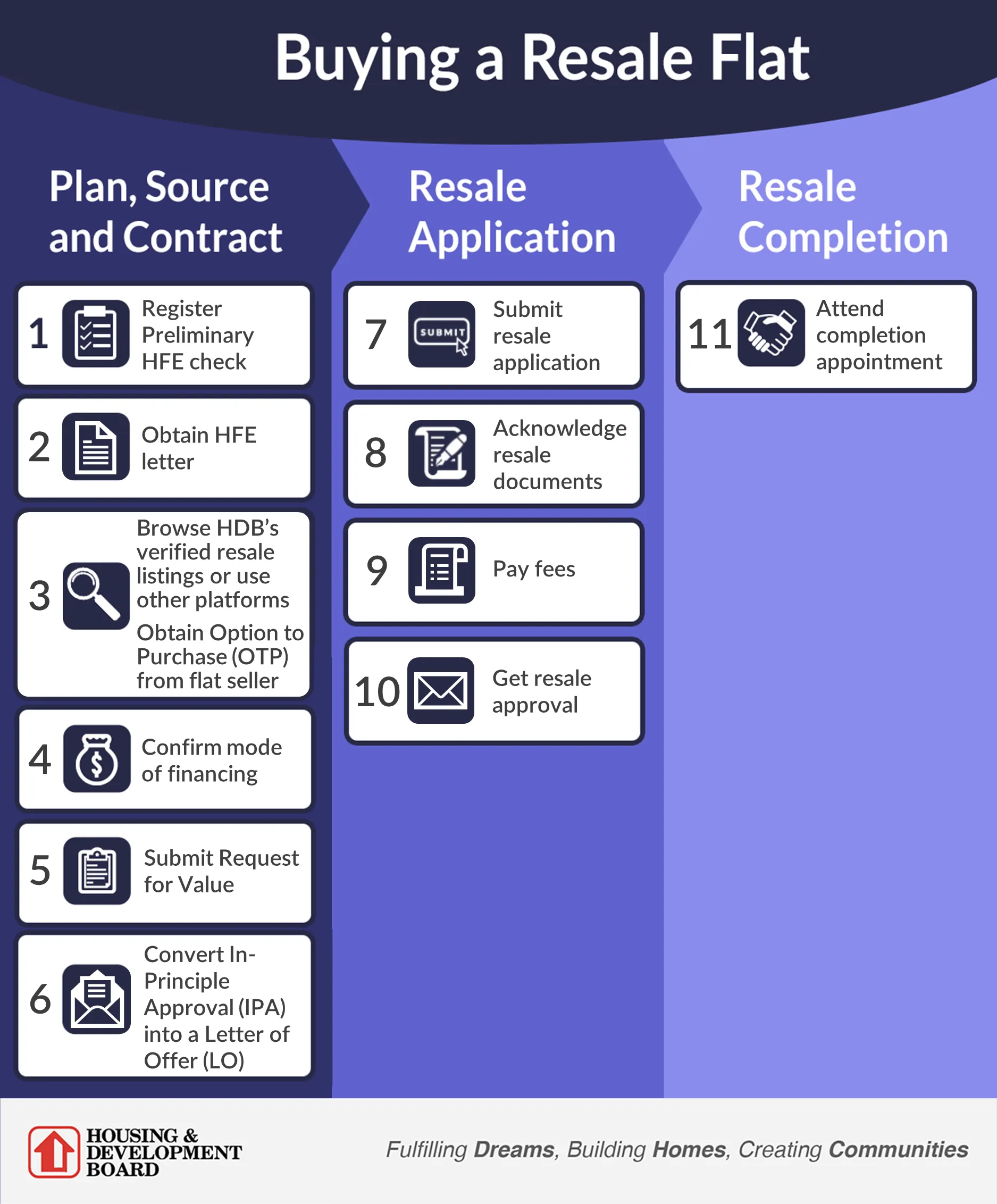

Here is an overview of the resale process should you wish to buy a HDB resale flat on your own.

Step 1 and 2: Obtain an HDB Flat Eligibility (HFE) Letter

Apply for an HDB Flat Eligibility (HFE) letter on My Flat Dashboard for a holistic understanding of your housing and financing options before you embark on your home buying journey. The HFE letter will inform you upfront of your eligibility to purchase a new or resale flat, as well as the amounts of CPF housing grants and HDB housing loan you are eligible for.

You may request for an In-Principle Approval (IPA) from the participating financial institutions when you apply for an HFE letter.

Step 3: Search for a suitable flat and obtain an Option to Purchase (OTP) from flat seller

After obtaining an HFE letter, you may look for a suitable flat that meets your budget and household needs.

When buying an HDB resale flat, your household must be within the Ethnic Integration Policy (EIP) quota for the block and neighbourhood and the Singapore Permanent Resident (SPR) quota, if applicable.

After you and the seller have agreed on the flat price, you can obtain an Option to Purchase (OTP) from the flat seller. The seller must have registered an Intent to Sell for more than seven days.

Note

If the seller is represented by a property agent, you will be asked by the property agent to provide information as part of their due diligence checks in a property transaction.

Step 4: Confirm mode of financing

HDB Housing Loan | Housing Loan from Financial Institution |

If you intend to get an HDB housing loan, you will need a valid HFE letter from HDB before flat sellers may grant you an OTP. If you have indicated that you intend to get an HDB housing loan in your HFE application, the loan outcome will be reflected in your HFE letter accordingly. | If you have indicated that you intend to get a housing loan from a financial institution in your HFE application, you must have a valid Letter of Offer (LO) before you exercise the OTP. You may concurrently request an In-Principle Approval and LO from participating financial institutions when applying for the HFE letter on My Flat Dashboard. |

Step 5: Submit Request for Value

If you are paying for the flat purchase with CPF savings and/ or housing loan, submit a Request for Value by the next working day after you receive the OTP.

You do not need to submit a Request for Value if you paying for your flat with cash (i.e., not using CPF savings and any housing loan).

Step 6: Convert In-Principle Approval into a Letter of Offer (LO)

If you have requested for an IPA while applying for the HFE letter, you can convert the IPA into an LO at this step, before exercising the OTP during the Option Period.

Step 7: Submit resale application

After you exercise the OTP, you and the sellers must submit the respective portions of the resale application via the My Flat Dashboard.

Step 8 and 9: Acknowledge resale documents and pay fees

Upon receiving a complete resale application and the full set of supporting documents from you and the sellers, HDB will verify the eligibility of both parties and accept the resale application within 28 working days.

HDB will prepare the necessary documents for you and the sellers to endorse, which will be ready about three weeks after the application has been accepted. You and the sellers must acknowledge and endorse the resale documents, and pay the necessary fees.

Step 10: Get resale approval

After the documents are endorsed and fees paid, HDB will grant an approval for the resale transaction.

Step 11: Attend completion appointment

The resale completion is about eight weeks from the date of HDB’s acceptance of the resale application. If you wish to defer the completion, please discuss with the sellers and inform HDB with a written confirmation (signed by both sellers and buyers) via MyRequest@HDB. You and the sellers will be notified via SMS of the appointment. You may also log in to My Flat Dashboard for the appointment details.

[Source: HDB InfoWEB – this webpage was last updated on 31 July 2025]

Note:

You can also log in to the My Flat Dashboard on the HDB Flat Portal, to be guided step-by-step on how to complete the property transaction.

If you are unfamiliar with the property transaction process or require assistance, you should consider engaging a property agent.