What Types of Monies Can Real Estate Salespersons Handle in a Property Transaction?

16 December 2025

Find out what are the transaction monies that real estate salespersons – property agents, in other words – can and cannot handle in a property transaction.

Dec 2025 – 3 min read

What types of monies are RESs allowed to handle in a property transaction?

Among the common questions that new real estate salespersons (RESs) and property consumers might have, this one is especially important as it involves dealing with money.

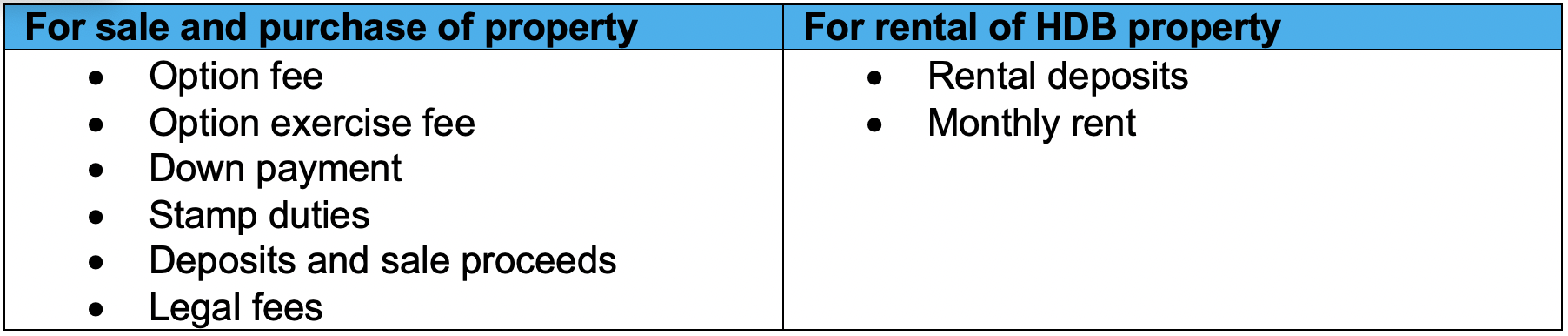

The answer: In general, RESs should not handle any transaction monies – they are strictly prohibited from handling the following:

Note: Valuation fees and agent commissions are not considered transaction monies in general.

Therefore, consumers should pay the payee directly (e.g. in the case of a HDB rental, the tenant should pay the owner of the HDB property directly) – and not pass the payment to the RES.

However, there are limited exceptions to the prohibition on handling transaction monies.

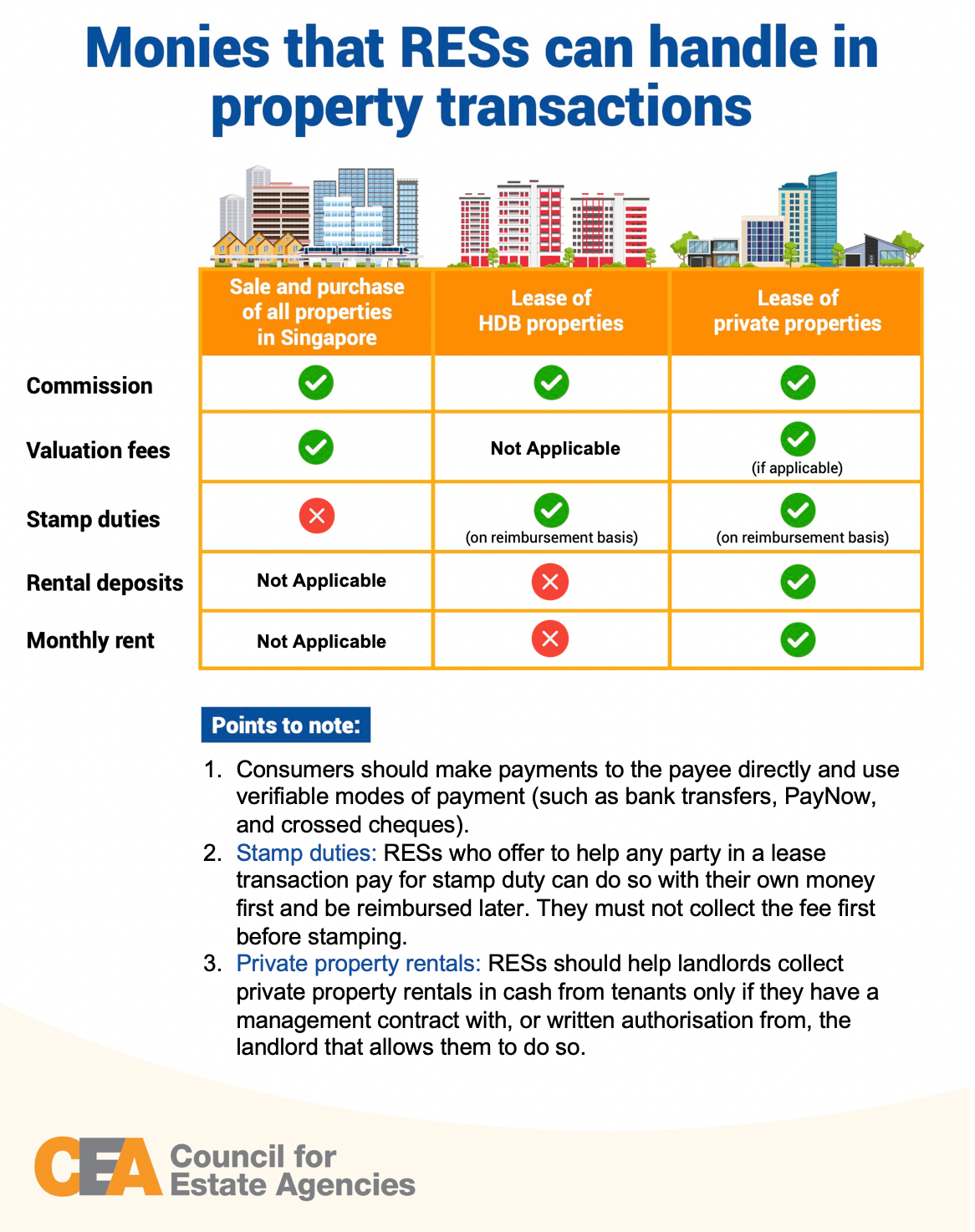

RESs are allowed to handle certain types of monies in a property transaction. The following table shows the kinds of payments involved in property transactions, and what RESs are allowed to handle:

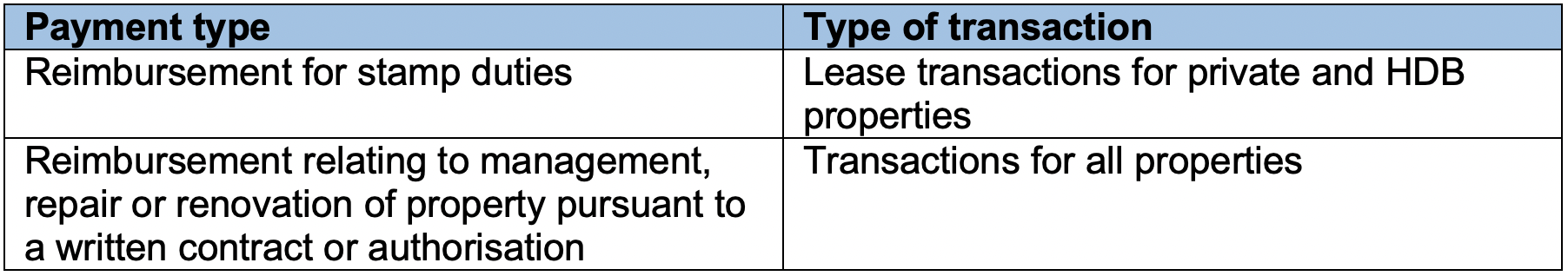

Reimbursement Situations

There may also be occasions where RESs might offer to help their clients make payments with their own money, and then ask their clients for reimbursement later, as in the case of stamp duties for lease transactions.

In the case of stamp duties, RESs must not collect the fee from their clients before stamping.

The table shows situations in which RESs are allowed to pay first on behalf of their clients, then seek reimbursement.

Consumers, take note: You should also take responsibility for your property transaction

We encourage property consumers to also take ownership of how your money is handled for your property transaction.

Property consumers are encouraged to make payments directly to the relevant payees through verifiable means such as bank transfers, PayNow, and crossed cheques – instead of passing monies through your property agent, either in cash or through transfer to their bank account.

Property consumers should also pay your property agent’s commission directly to his or her estate agent (EA), i.e. the company, and not to or through the agent.

Requesting property agents to manage certain types of monies, such as the monthly rent, could put the agent in a spot as it is an offence for them to handle transaction monies in general, and could result in the agent facing court prosecution and fines.

For more information, visit this page on the CEA website about the things to note before you engage a property agent.

Information accurate as at 16 Dec 2025